General information about IRS Tax Form 1099

The IRS Tax Form 1099 Income Statement is a tax document used to report various types of income other than wages, salaries, and tips. This form is primarily used to inform the Internal Revenue Service (IRS) about payments made to individuals or businesses that are not classified as employees. It helps ensure that all income is reported for tax purposes, thereby addressing compliance with federal tax laws.

Circumstances that call for this form

This form is typically used in several situations, including:

- When paying independent contractors or freelancers for services rendered.

- For reporting rental income received from real estate properties.

- When paying royalties to authors, artists, or inventors.

- For reporting certain types of miscellaneous income, such as prizes or awards.

Who might need IRS Tax Form 1099

The IRS Tax Form 1099 Income Statement should be used by:

- Business owners who hire independent contractors.

- Landlords receiving rental payments.

- Individuals or entities making royalty payments.

- Organizations awarding prizes or grants.

Document breakdown

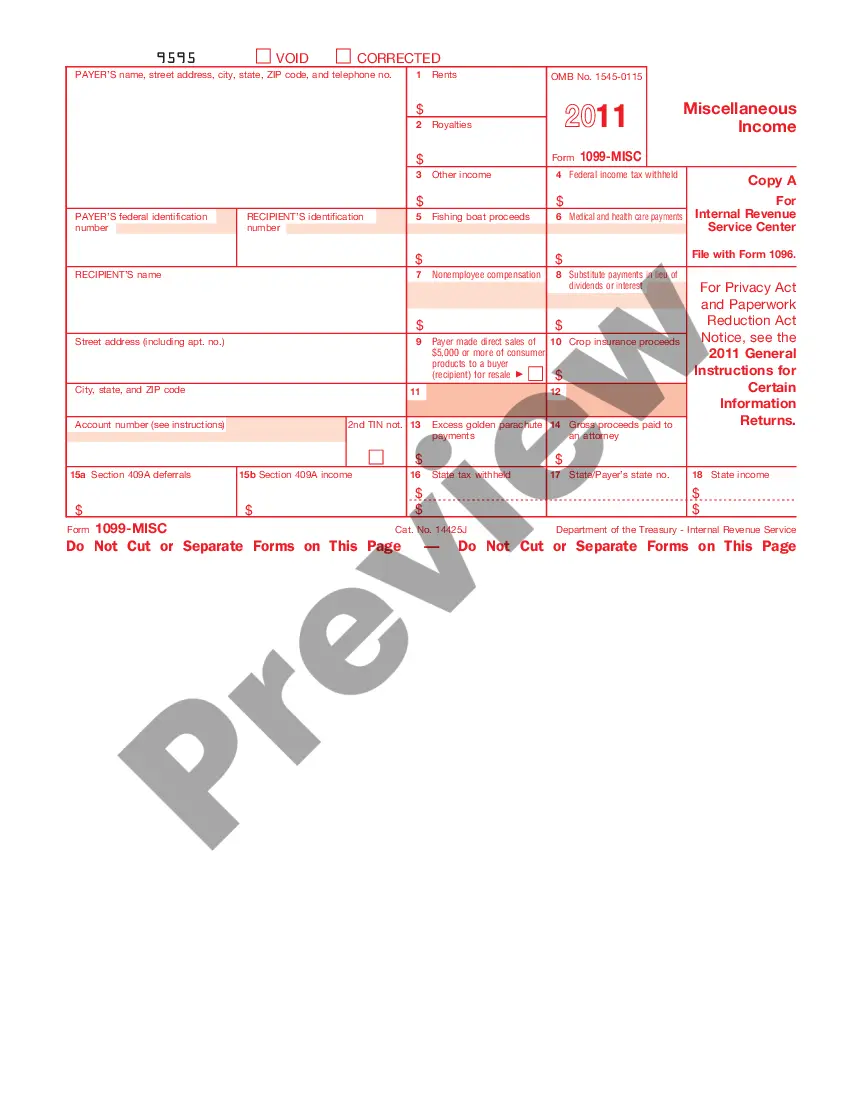

The main sections of the IRS Tax Form 1099 include:

- Payer's Information: Name, address, and identification number of the entity making the payment.

- Recipient's Information: Name, address, and identification number of the individual or entity receiving the payment.

- Income Types: Various boxes to report different types of income, such as rents, royalties, and other payments.

- Tax Withholding: Information about any federal or state taxes withheld from the payments.

- Corrections: A section to indicate if the form is a corrected version of a previously issued form.

Guide to completing the IRS Tax Form 1099

Follow these steps to accurately fill out the form:

- Identify the payer: Enter the name, address, and federal identification number of the entity making the payment.

- Identify the recipient: Provide the name, address, and identification number of the individual or business receiving the payment.

- Select the income type: Indicate the type of income being reported by checking the appropriate box (e.g., rents, royalties, nonemployee compensation).

- Report payment amounts: Enter the total amount paid in the relevant boxes, ensuring accuracy to avoid penalties.

- Complete tax withholding sections: If applicable, indicate any federal or state taxes withheld from the payments.

- Review and submit: Double-check all entries for accuracy before submitting the form to the IRS and providing a copy to the recipient.

Guidelines for state-level use

While the IRS Tax Form 1099 is a federal form, some states may have their own specific requirements for reporting income. Check with your state tax authority for any additional forms or regulations that may apply to your situation, especially if state taxes were withheld.

Advantages of using this form online

Accessing the IRS Tax Form 1099 Income Statement online offers several advantages:

- Convenience: Download and complete the form from anywhere at any time.

- Editability: Easily make corrections or adjustments before printing or submitting.

- Legal reliability: Ensure that you are using the most current version of the form, compliant with IRS regulations.