What to expect from Qualified Income Miller Trust

A Qualified Income Miller Trust is a legal document that establishes an irrevocable income trust. Its primary purpose is to manage and protect the income of an individual, particularly in the context of Medicaid eligibility. This trust allows the individual to receive income while ensuring that they meet the financial criteria for Medicaid assistance, which can be crucial for long-term care services.

When this form may be needed

This form is typically used in situations where an individual is applying for Medicaid benefits but has income that exceeds the allowable limit. Common scenarios include:

- Individuals seeking Medicaid coverage for long-term care.

- People who receive Social Security or pension income that may disqualify them from Medicaid.

- Those needing to protect their assets while still receiving necessary medical assistance.

Common users of Qualified Income Miller Trust

This form is intended for:

- Individuals who are Trustors, meaning they are establishing the trust.

- Trustees, who will manage the trust assets and income.

- Beneficiaries who may receive assets from the trust upon the Trustor's death.

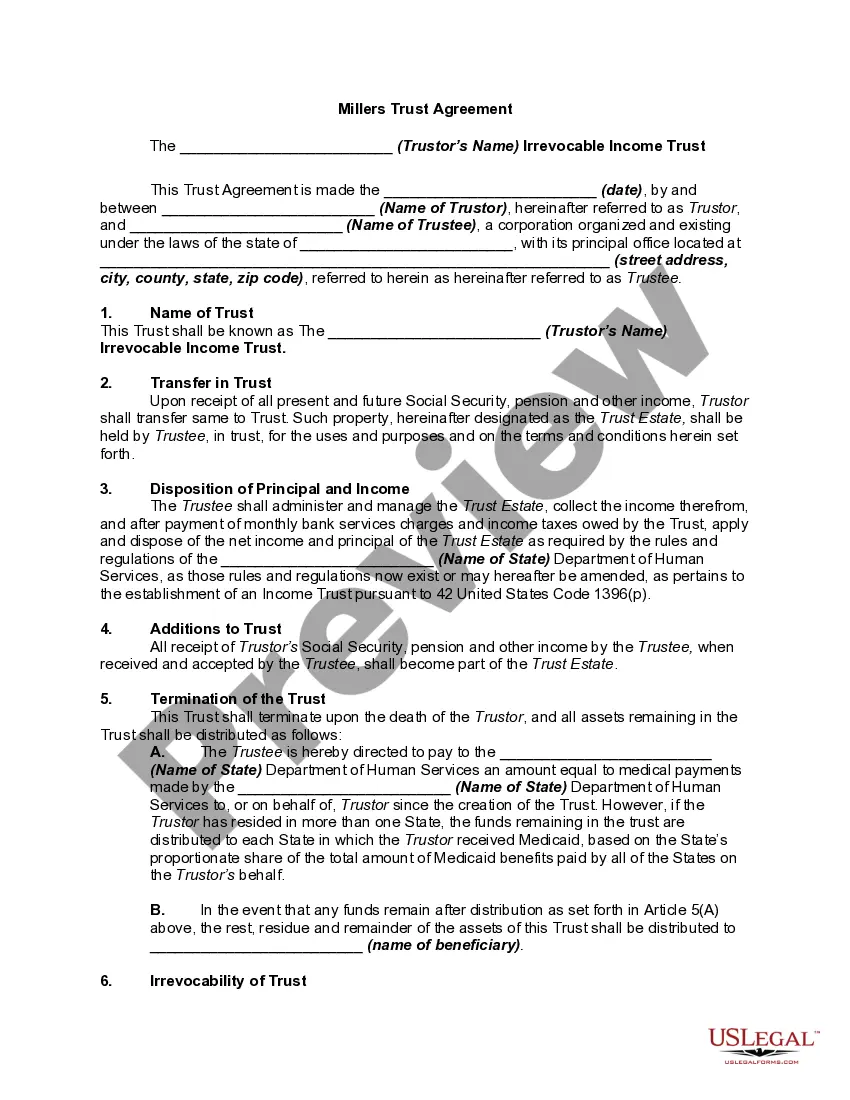

Key components of this form

The Qualified Income Miller Trust includes several important sections:

- Trustor and Trustee Information: Names and details of the individuals or entities involved.

- Trust Name: The official name of the trust.

- Transfer in Trust: Details on what income will be transferred to the trust.

- Disposition of Principal and Income: Instructions on how the trust's assets will be managed and distributed.

- Termination of the Trust: Conditions under which the trust will end and how remaining assets will be handled.

- Powers of Trustee: Authority granted to the trustee for managing the trust.

- Governing Law: The state laws that will govern the trust agreement.

Steps to complete Qualified Income Miller Trust

Follow these steps to fill out the Qualified Income Miller Trust:

- Identify the parties: Fill in the names of the Trustor and Trustee, along with their respective addresses.

- Name the trust: Assign a name to the trust that reflects the Trustor's identity.

- Specify the income transfer: Indicate what income (e.g., Social Security, pension) will be transferred into the trust.

- Outline the management of assets: Describe how the Trustee will manage the trust assets and distribute income according to regulations.

- Detail termination conditions: State what will happen to the trust assets upon the Trustor's death, including payments to the state for Medicaid costs.

- Sign and date: Ensure that both the Trustor and Trustee sign the document in the presence of a notary public.

Requirements that vary by state

The Qualified Income Miller Trust must comply with the laws of the state where it is established. Each state may have specific regulations regarding:

- The format and language used in the trust agreement.

- Reporting requirements to the state Department of Human Services.

- Distribution rules for Medicaid reimbursements.

Access this form when and where you need it

Accessing the Qualified Income Miller Trust online offers several advantages:

- Convenience: Download the form anytime and anywhere, without needing to visit a legal office.

- Editability: Easily fill out and customize the form to meet your specific needs.

- Legal reliability: Ensure that the form is up-to-date with current laws and regulations, drafted by licensed attorneys.