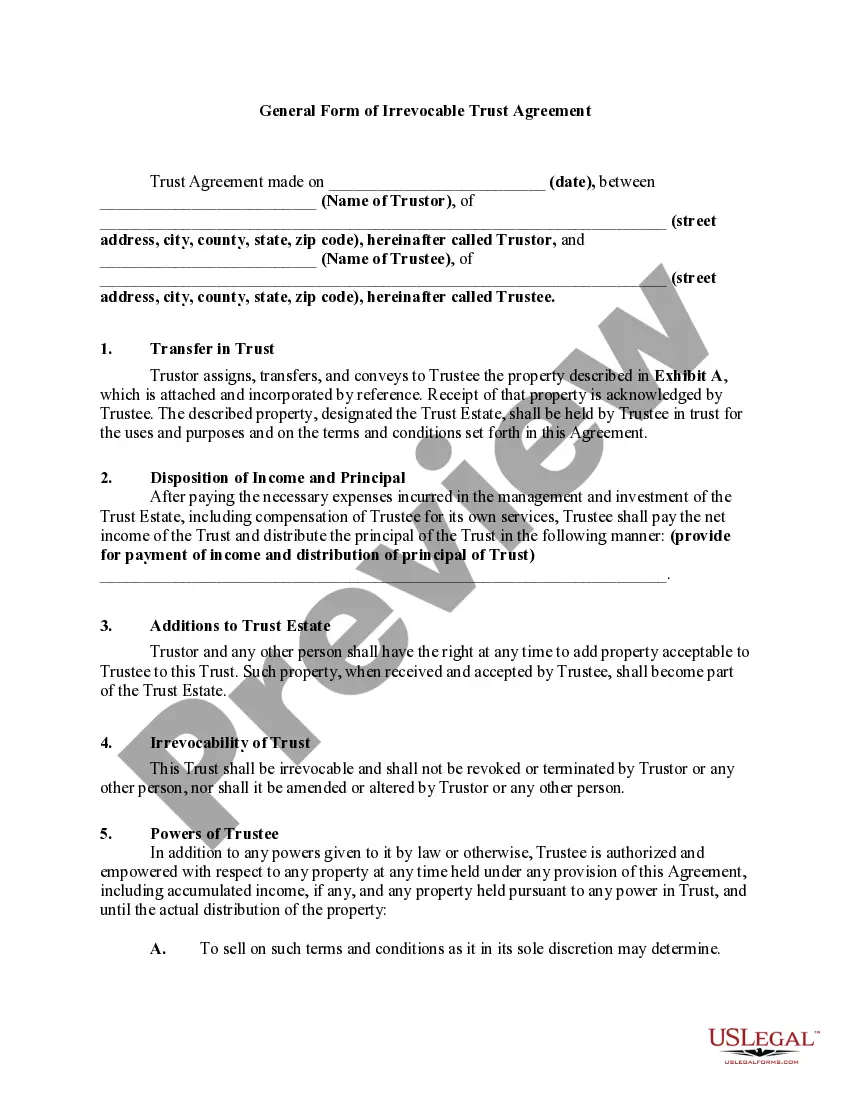

What to expect from General Form of Irrevocable Trust Agreement

A General Form of Irrevocable Trust Agreement is a legal document that establishes a trust, which cannot be altered or revoked once created. This agreement allows the Trustor to transfer assets into the trust, managed by a Trustee for the benefit of designated beneficiaries. It serves to protect the assets from creditors and ensure they are distributed according to the Trustor's wishes.

Reasons you might need this form

This form is typically used in the following situations:

- When an individual wishes to set aside assets for beneficiaries while maintaining control over their distribution.

- To minimize estate taxes and protect assets from creditors.

- When planning for long-term care or ensuring financial support for dependents.

- In estate planning to specify how assets should be managed and distributed after death.

Intended audience of General Form of Irrevocable Trust Agreement

This form is intended for:

- Individuals looking to create an irrevocable trust for estate planning purposes.

- Parents wanting to secure financial support for their children or dependents.

- Anyone wishing to protect assets from potential future claims or creditors.

Key components of this form

The General Form of Irrevocable Trust Agreement includes several important sections:

- Transfer in Trust: Details the property being transferred into the trust.

- Disposition of Income and Principal: Outlines how income and principal will be distributed.

- Additions to Trust Estate: Allows for additional property to be added to the trust.

- Irrevocability of Trust: States that the trust cannot be revoked or amended.

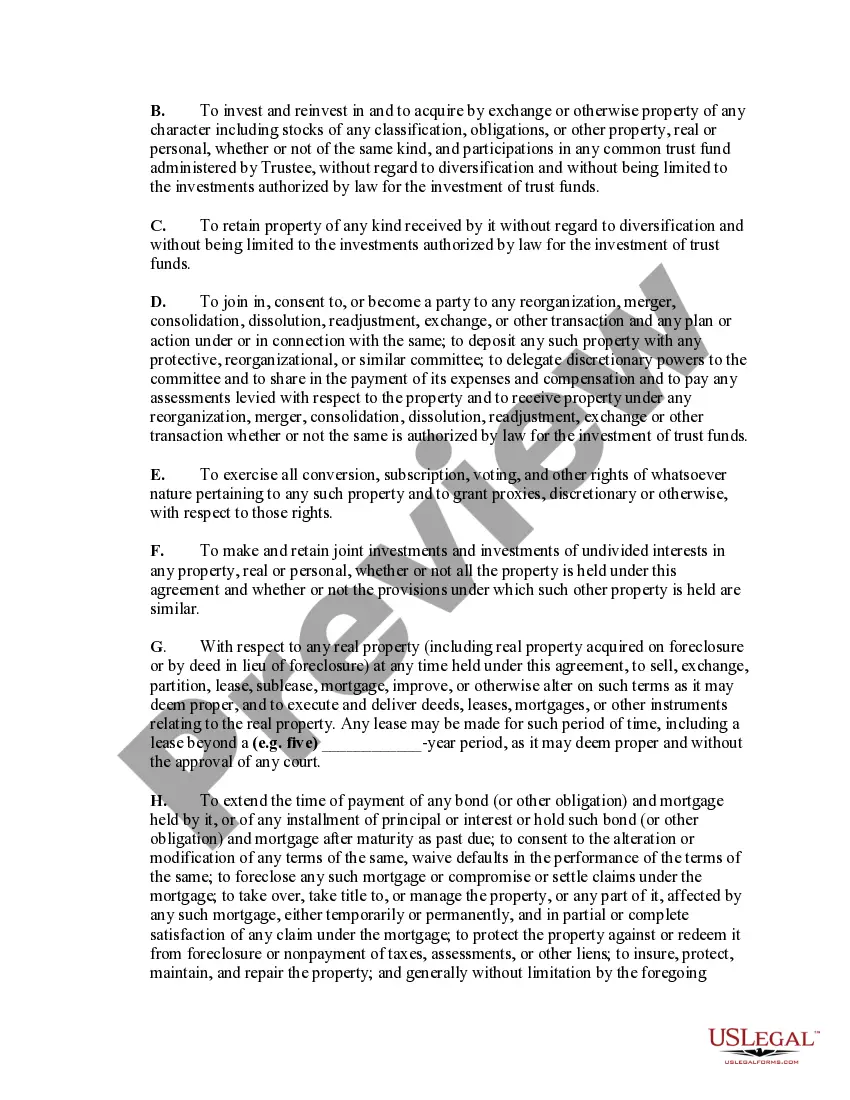

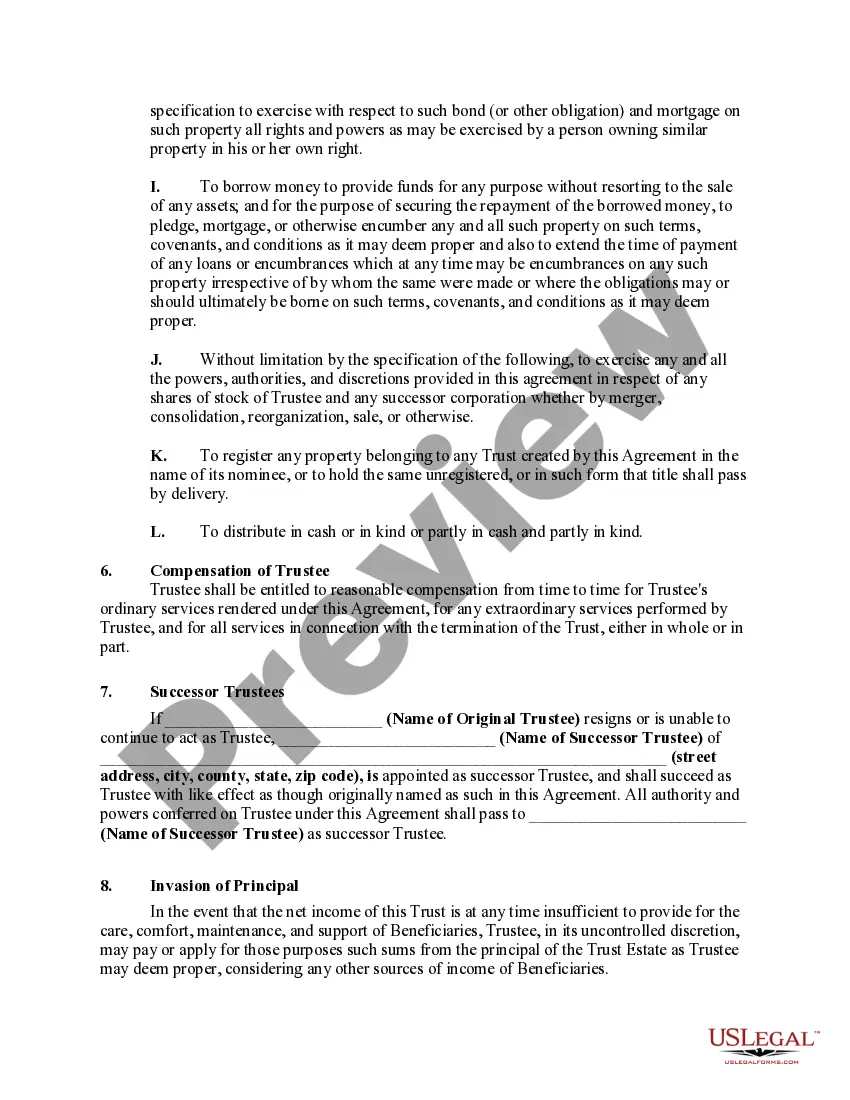

- Powers of Trustee: Lists the authority granted to the Trustee regarding the management of trust assets.

- Successor Trustees: Identifies who will take over if the original Trustee can no longer serve.

- Governing Law: Indicates which state's laws govern the trust agreement.

Instructions for General Form of Irrevocable Trust Agreement

To fill out this form, follow these steps:

- Define the parties involved: Enter the names and addresses of the Trustor (the person creating the trust) and the Trustee (the person managing the trust).

- Describe the property: Specify the assets being transferred into the trust in the section designated for the Trust Estate.

- Outline income distribution: Indicate how the income generated from the trust will be distributed to beneficiaries.

- Specify Trustee powers: Review and confirm the powers granted to the Trustee, ensuring they align with your intentions.

- Sign and date: Both the Trustor and Trustee must sign the agreement, indicating their acceptance of the terms.

How state laws may affect this form

The form may need to comply with specific state laws regarding trusts. It is essential to ensure that the governing law section accurately reflects the state where the trust is established. Different states may have varying requirements for the execution and notarization of trust agreements.

What makes the online version easier to use

Accessing the General Form of Irrevocable Trust Agreement online offers several advantages:

- Convenience: Users can download and complete the form at their own pace, from anywhere.

- Editability: Digital forms can be easily modified to suit specific needs before finalizing.

- Legal reliability: The templates are drafted by licensed attorneys, ensuring they meet legal standards.