Introduction to Certificate of Trust with Real Property

A Certificate of Trust with Real Property as Part of the Corpus is a legal document that verifies the existence of a trust and outlines its key details. This form is specifically designed to include real property as part of the trust's assets. It serves as proof of the trust's authority to manage and transfer real estate, ensuring that the trustee can act on behalf of the trust without disclosing the full trust agreement.

In what situations this form is used

This certificate is commonly used in various scenarios, including:

- When transferring ownership of real estate into a trust.

- When a trustee needs to demonstrate their authority to manage trust property.

- During estate planning to ensure smooth transitions of property upon the grantor's death.

- When dealing with financial institutions or real estate transactions that require proof of the trust.

Who can benefit from Certificate of Trust with Real Property

This form is suitable for:

- Trustees who are managing a trust that includes real property.

- Grantors who wish to establish a trust and include real estate as part of its assets.

- Beneficiaries who need to understand the trust's structure and authority.

- Legal professionals assisting clients with estate planning and property management.

Main sections of this form

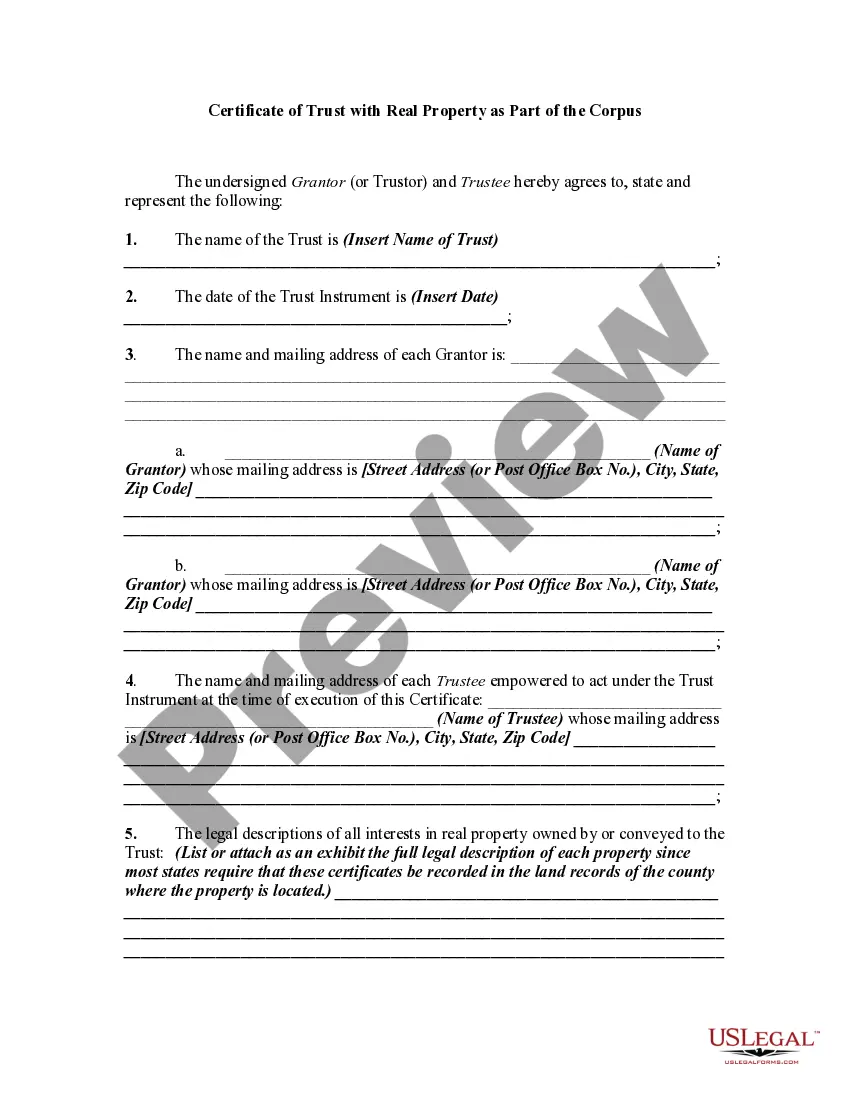

The Certificate of Trust includes several important sections, such as:

- Name of the Trust: Identifies the specific trust.

- Date of the Trust Instrument: Indicates when the trust was created.

- Grantor Information: Lists the names and addresses of individuals who established the trust.

- Trustee Information: Details the trustees authorized to act on behalf of the trust.

- Legal Descriptions of Real Property: Provides the legal details of properties owned by the trust.

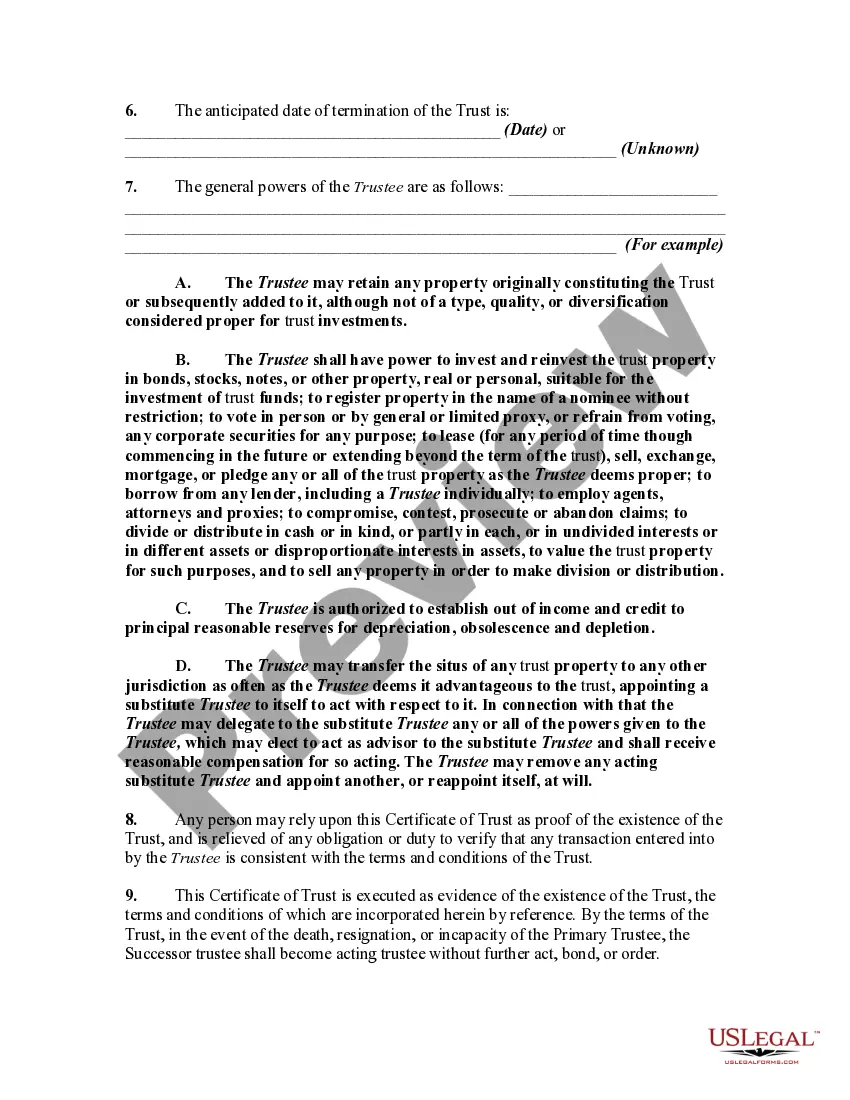

- Trust Termination Date: States when the trust is expected to end.

- Powers of the Trustee: Outlines the authority granted to the trustee in managing the trust assets.

Completion tips for the Certificate of Trust with Real Property

Follow these steps to fill out the certificate:

- Identify the Trust: Enter the name of the trust and the date the trust instrument was created.

- List the Grantors: Provide the names and addresses of all grantors involved in establishing the trust.

- Specify the Trustees: Include the names and addresses of the trustees authorized to manage the trust.

- Detail the Real Property: Attach legal descriptions of all real estate owned by the trust, ensuring compliance with local recording requirements.

- State the Termination Date: Indicate when the trust will terminate or state if it is unknown.

- Outline Trustee Powers: Clearly define the powers granted to the trustee for managing the trust's assets.

What to know about state compliance

The requirements for a Certificate of Trust may vary by state. It is essential to ensure that the form complies with local laws regarding:

- Recording the certificate in the appropriate county office.

- Specific language or clauses required by state trust laws.

- Notarization or witness requirements for the document to be legally binding.

Make changes easily with the online form

Accessing the Certificate of Trust online offers several advantages:

- Convenience: Download and complete the form at your own pace from anywhere.

- Editability: Easily modify the document as needed before finalizing it.

- Legal Reliability: Ensure that you are using a form that is drafted by licensed attorneys, tailored to meet legal standards.