What is this General Durable Power of Attorney for Property and Finances

This document is a legal instrument that allows you to appoint an agent to manage your financial affairs and property. It grants your agent broad powers to act on your behalf, even if you become incapacitated or unable to make decisions. This power of attorney does not cover medical or healthcare decisions, which require a separate document.

When this form is most appropriate

This form is useful in various situations, including:

- If you anticipate being unable to manage your finances due to health issues.

- When you want to ensure someone can handle your financial matters during a prolonged absence.

- If you wish to designate a trusted person to manage your assets in case of sudden incapacity.

Who can benefit from General Durable Power of Attorney for Property and Finances

This form is intended for individuals who want to establish a durable power of attorney for their financial affairs. It is particularly relevant for:

- Adults planning for potential future incapacity.

- Individuals with significant assets or complex financial situations.

- People who want to ensure their financial matters are managed by a trusted person.

What you'll need to complete

The main sections of this power of attorney include:

- Principal and Agent Information: Names and addresses of the person granting authority and the designated agent.

- Powers Granted: A detailed list of the financial powers you are granting to your agent.

- Limitations: Any specific restrictions on the agent's authority, if applicable.

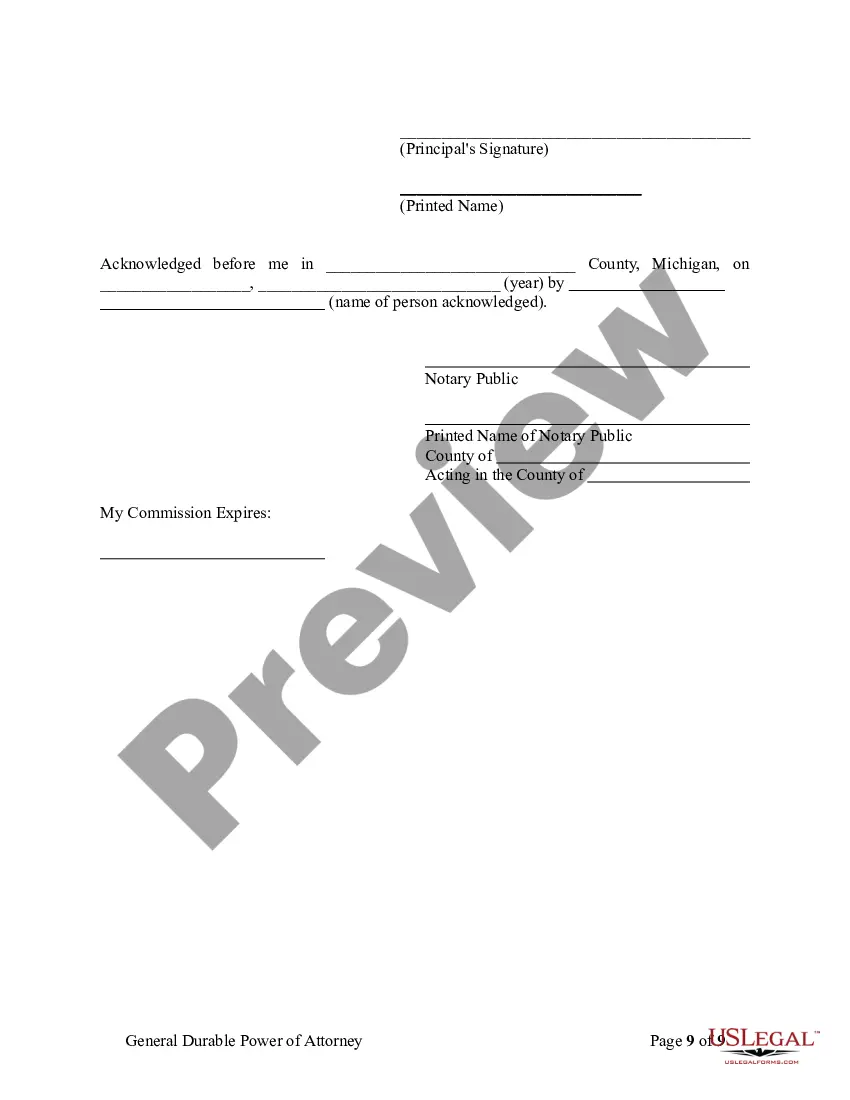

- Signature and Notarization: The principal's signature and a notary public's acknowledgment to validate the document.

Instructions for General Durable Power of Attorney for Property and Finances

Follow these steps to fill out the form:

- Identify the Parties: Enter your name and address as the principal, and the name and address of your chosen agent.

- Specify Powers: Clearly outline the financial powers you wish to grant your agent, including any specific limitations.

- Include Additional Instructions: If desired, provide any special instructions or limitations regarding the agent's authority.

- Sign the Document: Sign and date the form in the presence of a notary public to ensure its validity.

- Distribute Copies: Provide copies of the signed document to your agent and any relevant financial institutions.

What changes based on your state

This power of attorney is governed by Michigan law. It must be signed by the principal and notarized to be legally binding. Ensure that the document complies with any additional state-specific regulations or requirements that may apply.

Benefits of completing the form online

Accessing this form online offers several advantages:

- Convenience: Download and complete the form at your own pace, without needing to visit a law office.

- Editability: Easily make changes or updates to the document as needed.

- Legal Reliability: The form is drafted by licensed attorneys, ensuring it meets legal standards.