Explanation of the General Durable Power of Attorney for Property and Finances

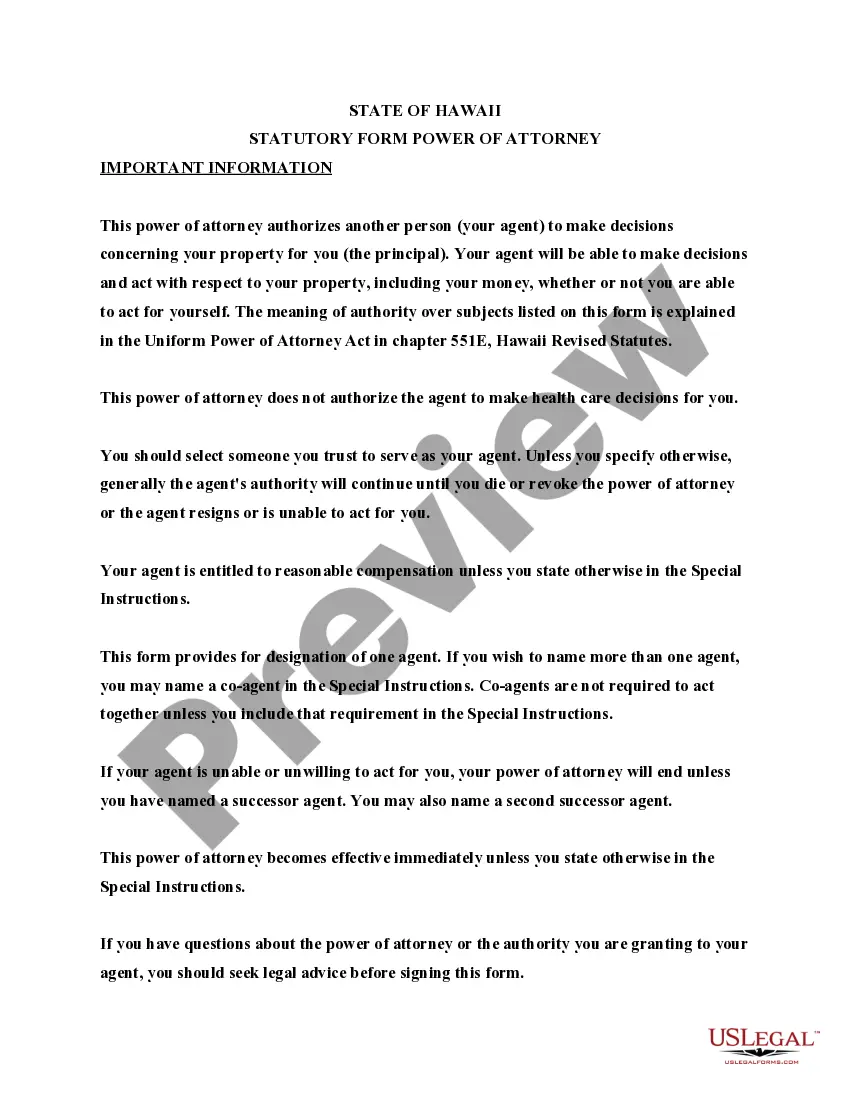

This legal document allows an individual, referred to as the principal, to designate another person, known as the agent, to manage their property and financial matters. The agent can make decisions regarding the principal's assets, including money, real estate, and other financial interests. It is important to note that this form does not grant the agent authority over health care decisions.

When this form typically applies

This form is useful in various situations, such as:

- When the principal is unable to manage their financial affairs due to illness or disability.

- When the principal is traveling or residing in a different location and needs someone to handle their financial matters.

- To ensure that financial decisions can be made in a timely manner if the principal becomes incapacitated.

Who should consider General Durable Power of Attorney for Property and Finances

This form is intended for individuals who wish to appoint a trusted person to manage their financial affairs. It is suitable for:

- Individuals planning for potential future incapacity.

- People who want to ensure their financial matters are handled by someone they trust.

- Those who may be temporarily unavailable to manage their finances.

Sections you'll find in this form

The Hawaii Statutory Form of Power of Attorney includes several essential sections:

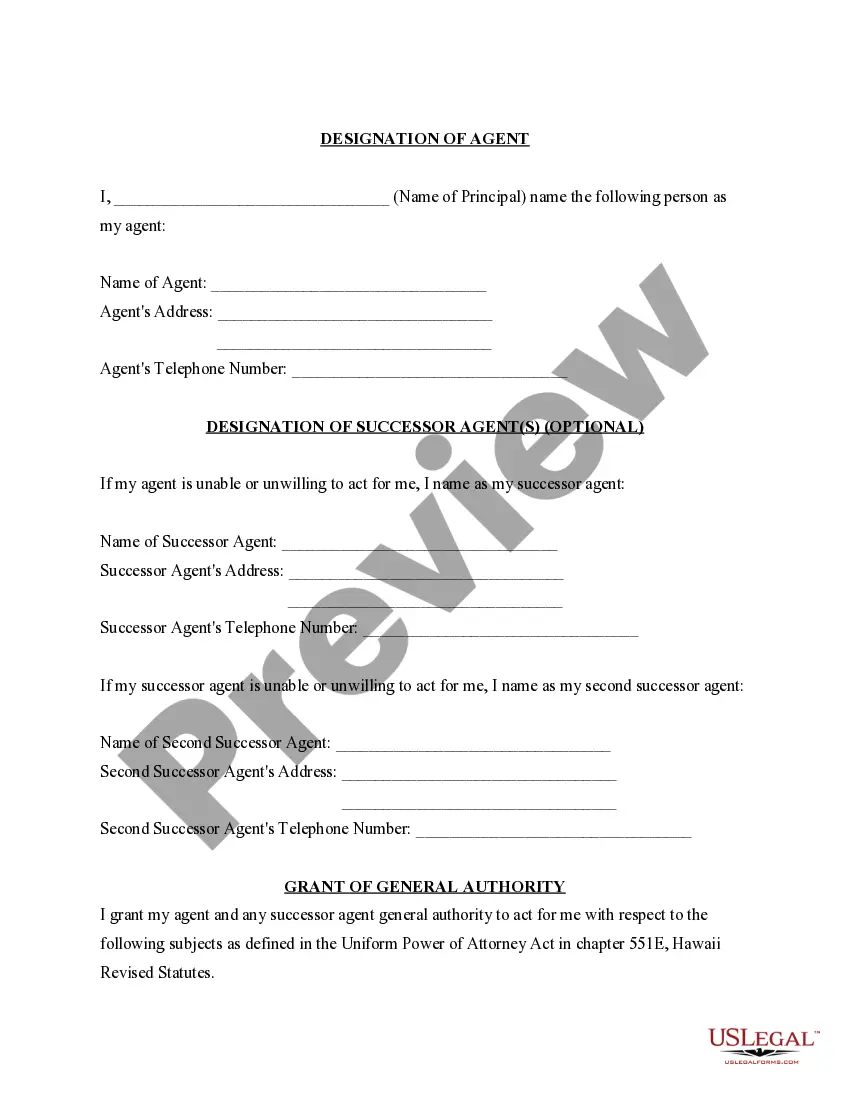

- Designation of Agent: Names the individual authorized to act on behalf of the principal.

- Designation of Successor Agents: Allows the principal to name alternate agents if the primary agent is unable to serve.

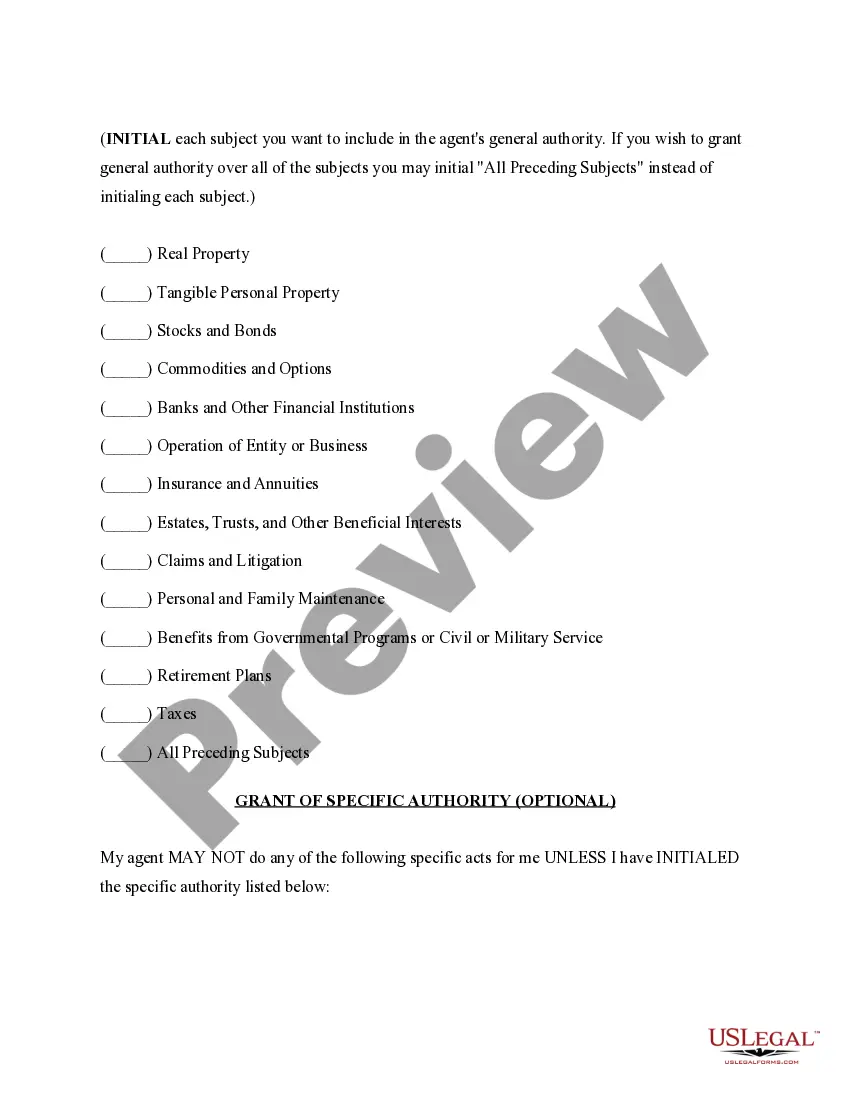

- Grant of General Authority: Specifies the areas in which the agent can act, such as real estate, banking, and taxes.

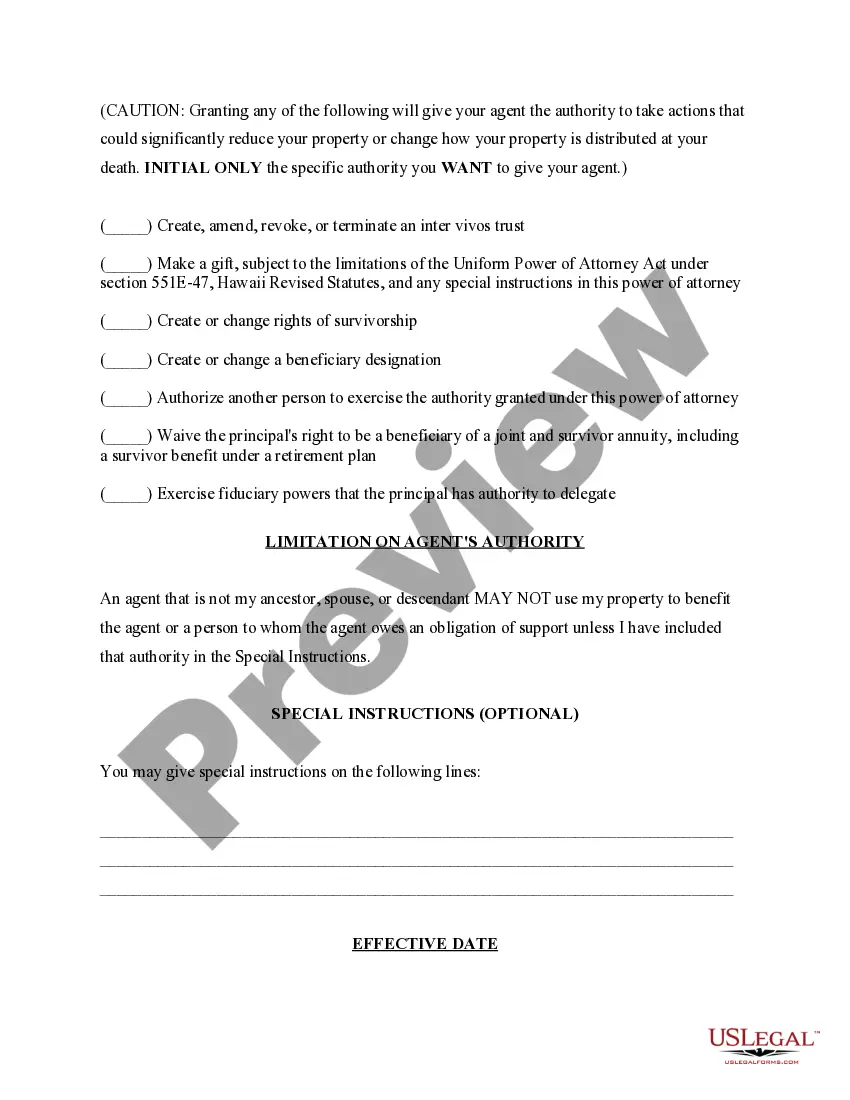

- Grant of Specific Authority: Lists specific actions the agent may not take unless explicitly authorized by the principal.

- Special Instructions: Provides space for any additional directives from the principal.

- Signature and Acknowledgment: Requires the principal's signature and may need notarization for validity.

Tips for filling out the General Durable Power of Attorney for Property and Finances

Follow these steps to fill out the form:

- Identify the Parties: Enter your name as the principal and the name of the agent you are appointing.

- Designate Successor Agents: If desired, name one or two successor agents to act if the primary agent cannot.

- Grant Authority: Initial next to the areas where you wish to grant your agent authority, such as real property or banking.

- Specify Limitations: If there are specific actions you do not want your agent to take, initial those sections accordingly.

- Add Special Instructions: Include any additional instructions or limitations you want to impose on your agent.

- Sign and Date: Finally, sign the document and date it, ensuring it is acknowledged by a notary if required.

Guidelines for state-level use

This form is specifically designed to comply with the laws of Hawaii, particularly the Uniform Power of Attorney Act outlined in Chapter 551E of the Hawaii Revised Statutes. It includes provisions unique to this jurisdiction, such as the requirement for notarization and specific language that must be included to ensure the document's validity.

Complete this form from anywhere

Accessing the Hawaii Statutory Form of Power of Attorney online offers several advantages:

- Convenience: Download and complete the form at your own pace from the comfort of your home.

- Editability: Easily make changes or updates as needed without the hassle of physical paperwork.

- Legal Reliability: Ensure you have the most current version of the form that complies with state laws.