Introduction to Quitclaim Deed

An Arkansas Quitclaim Deed from Individual to Individual is a legal document used to transfer ownership of real property from one individual to another without guaranteeing that the title is clear. This type of deed is often used when the grantor (the person transferring the property) wants to relinquish any claim to the property, but does not provide any assurances about the property's title or condition.

When this document is the right choice

This form is commonly used in various situations, including:

- Transferring property between family members, such as parents to children.

- Conveying property as part of a divorce settlement.

- Transferring property to a partner or friend without a formal sale.

- Clearing up title issues by relinquishing claims to a property.

Who should consider Quitclaim Deed

This form is suitable for:

- Individuals transferring property to another individual.

- Married couples who need to transfer property between themselves.

- Anyone looking to clarify property ownership without a sale.

Overview of form content

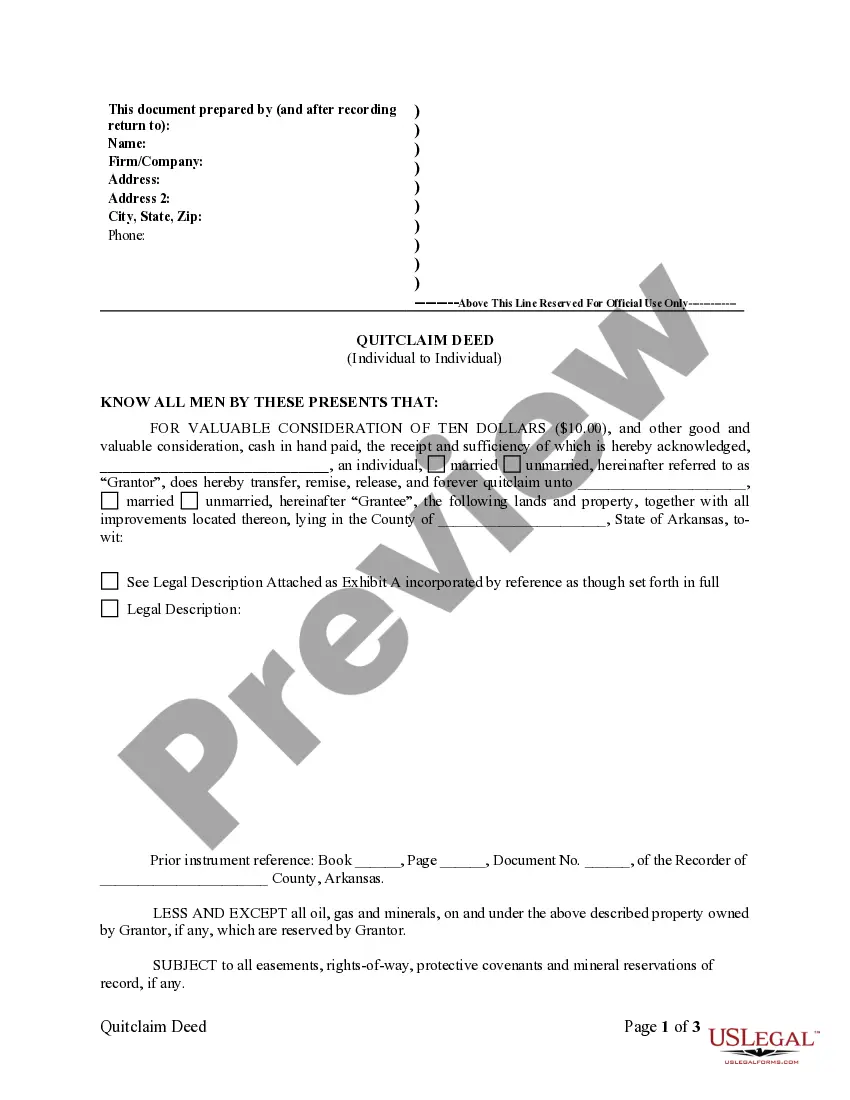

The Arkansas Quitclaim Deed includes several important sections, such as:

- Grantor and Grantee Information: Names and marital status of the individuals involved in the transfer.

- Property Description: Details about the property being transferred, including its location and any relevant legal references.

- Consideration: The amount of money or other value exchanged for the property.

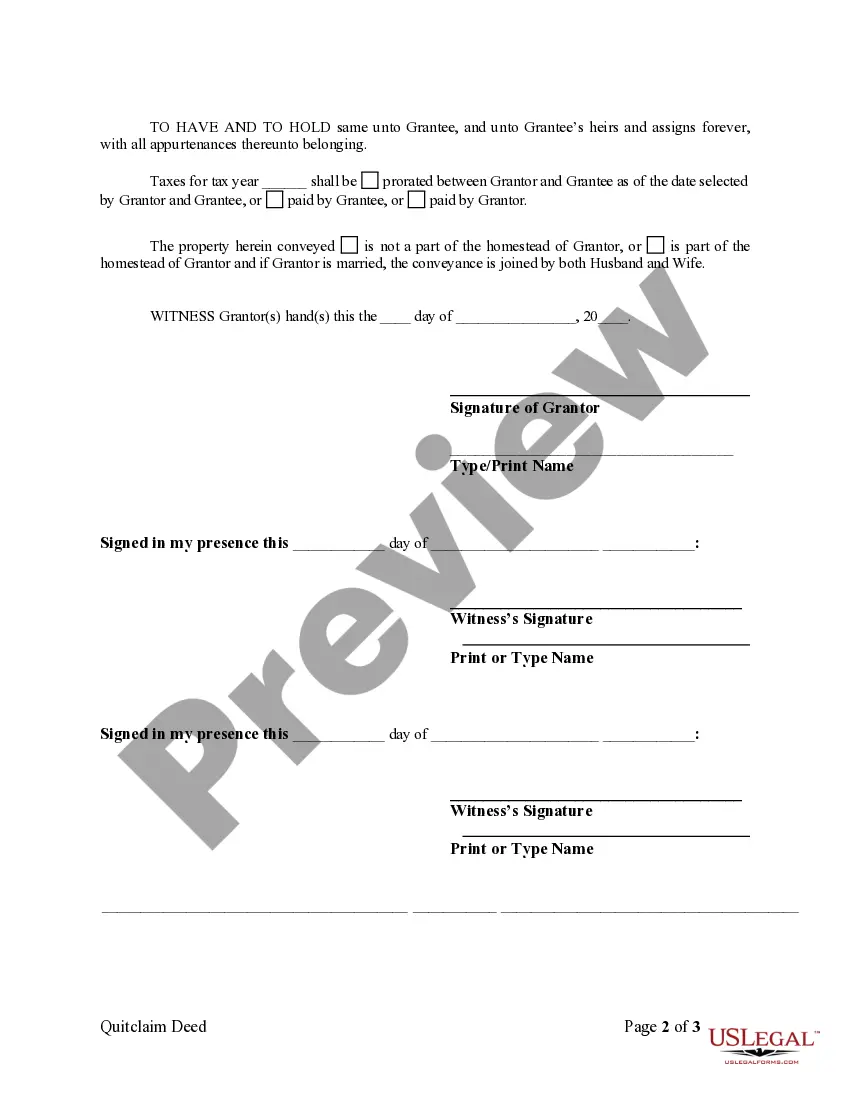

- Tax Proration: Instructions on how property taxes will be handled between the parties.

- Signatures: Spaces for the grantor and witnesses to sign, as well as notary acknowledgment.

How to complete Quitclaim Deed

Follow these steps to fill out the form:

- Identify the Parties: Clearly state the names of the grantor (the person giving up the property) and the grantee (the person receiving the property), including their marital status.

- Describe the Property: Provide a detailed description of the property being transferred, including its location and any legal references from previous documents.

- Specify Consideration: Indicate the amount of consideration being exchanged, typically a nominal amount like ten dollars.

- Address Tax Responsibilities: Decide how property taxes will be prorated or paid between the parties.

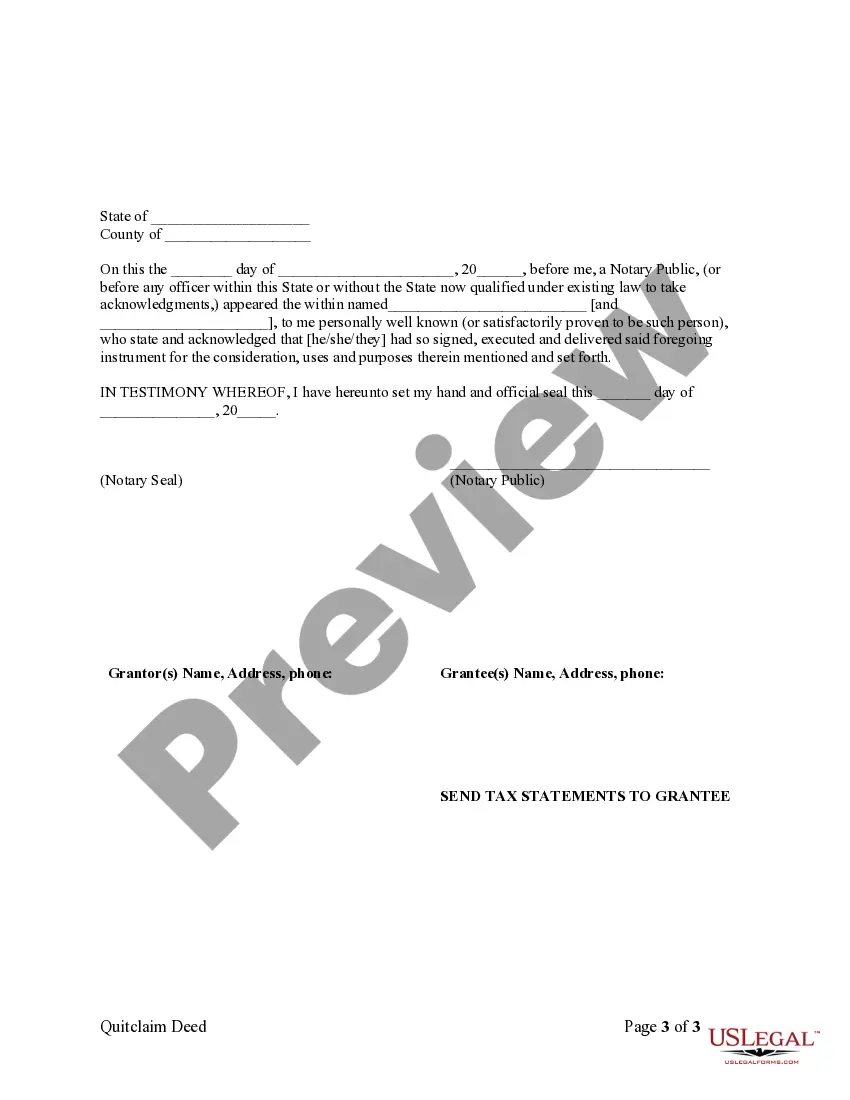

- Sign and Date: Both the grantor and witnesses must sign and date the document, and it should be notarized to be legally binding.

Where this form is valid and how

This quitclaim deed is specifically designed to meet the legal requirements of Arkansas. It includes necessary elements such as notarization and witness signatures, which are essential for the deed to be valid in this state. Additionally, the form addresses local property laws and tax considerations applicable in Arkansas.

Access this form when and where you need it

Accessing the Arkansas Quitclaim Deed online offers several advantages:

- Convenience: Download and complete the form at your own pace, without needing to visit a legal office.

- Editability: Easily modify the form as needed to fit your specific situation.

- Legal Reliability: Ensure you are using a template that complies with Arkansas laws, drafted by licensed attorneys.